Free Market Capitalism vs. Monopoly Stakeholder Capitalism:

Assessing the Benefits and Drawbacks

Klaus Schwab, founder of the World Economic Forum, once envisioned a world where “you will own nothing and be happy.” This bold statement encapsulates the evolving landscape of economic systems. Schwab's words challenge us to explore the contrasting realms of free market capitalism and monopoly stakeholder capitalism, assessing their benefits and drawbacks. Our mission is to examine their influence on economic efficiency, individual freedom, wealth distribution, and societal well-being. By scrutinizing these economic paradigms, we aim to unravel their implications for the future and ponder the question: Can we find happiness in a world where ownership takes a new form?

Introduction

The economic systems of free market capitalism and monopoly stakeholder capitalism represent two distinct approaches to organizing and regulating markets. This essay will analyze the merits and drawbacks of both systems, exploring their impact on economic efficiency, innovation, wealth distribution, and societal well-being. By examining the advantages and disadvantages of each system, we can gain a deeper understanding of their implications for economic prosperity and social outcomes.

Body:

Free Market Capitalism:

a. Benefits: Economic Efficiency

Free market capitalism fosters competition, incentivizing businesses to operate efficiently. In a competitive environment, companies strive to produce high-quality goods and services to gain a competitive edge. This drive for efficiency not only benefits businesses but also consumers who receive better products at competitive prices. Furthermore, the constant quest for innovation is a hallmark of free market capitalism, leading to advancements in technology, business practices, and product offerings.

Historical examples of economic efficiency under free market capitalism include the rapid growth of the technology sector in Silicon Valley, where numerous startups compete to develop cutting-edge innovations, and the global success of companies like Apple and Amazon, which continually adapt and improve their products to meet consumer demands.

For a more in-depth exploration of economic efficiency, you can refer to this source: Economic Efficiency 28 June 2019 by Tejvan Pettinger

b. Benefits: Individual Freedom

Free market capitalism champions individual freedom and choice. In this system, individuals possess the autonomy to pursue their own economic interests and carve out their life paths. This freedom extends to entrepreneurship, enabling individuals to establish businesses and follow their entrepreneurial aspirations. It empowers consumers to make choices rooted in their preferences, fostering a diverse marketplace that caters to a wide array of tastes and needs.

Illustrating the power of individual freedom in free market capitalism, we find inspiration in the story of Elon Musk, the visionary entrepreneur behind Tesla, SpaceX, and other groundbreaking ventures. Musk's journey exemplifies the essence of freedom in capitalism— the liberty to create, innovate, and shape industries.

To delve further into the philosophical foundations of individual freedom and capitalism, consider exploring F.A. Hayek's seminal work, “The Road to Serfdom.”

c. Benefits: Wealth Creation

Free market capitalism has historically been associated with higher levels of wealth creation. This economic system encourages entrepreneurship, investment, and risk-taking, which can lead to substantial wealth accumulation. The accumulation of wealth isn't limited to individuals; it also translates into increased capital available for investment, economic growth, and job creation.

Historical examples include the economic boom in the United States during the late 19th century, often referred to as the Gilded Age. During this period, industrialization and technological advancements fueled significant wealth creation and contributed to the country's economic development.

For a more detailed exploration of how capitalism fosters wealth creation, you can refer to Britannica's comprehensive overview of capitalism. https://www.britannica.com/money/topic/capitalism

This source provides valuable insights into the foundational principles and historical context of capitalism, further illuminating its role in wealth generation.

When examining notable business figures who significantly contributed to wealth creation during specific eras, it's impossible to overlook the influential role of individuals like John D. Rockefeller. His remarkable journey and achievements during the Gilded Age are a testament to the power of entrepreneurship and innovation. For a detailed historical account of John D. Rockefeller's life and his profound impact on wealth creation, you can explore his Wikipedia page. This resource provides a comprehensive overview that can serve as a starting point for deeper research.

d. Drawbacks: Income Inequality

Critics argue that free market capitalism can lead to wealth concentration in the hands of a few, exacerbating income inequality. As businesses and individuals amass wealth, the gap between the wealthiest and the rest of society can widen. Income inequality can have social and economic consequences, including disparities in access to education, healthcare, and economic opportunities.

Recent data illustrating income inequality trends in developed countries, along with examples of billionaire wealth accumulation, can underscore this drawback. For a comprehensive analysis of the intricate relationship between economic freedom, income inequality, and overall well-being, you can delve into the article titled "Economic Freedom, Income Inequality, and Happiness: New Evidence" published in the journal. Economic Analysis and Policy https://www.sciencedirect.com/science/article/pii/S2215016121001953.

This study provides valuable insights into the complexities of income distribution within free market economies.

By examining both contemporary data and in-depth research, we gain a holistic view of the challenges posed by income inequality in the context of capitalism. This multifaceted understanding is essential for addressing the social and economic consequences associated with wealth concentration.

e. Drawbacks: Market Failures

Unregulated markets in free market capitalism can experience market failures, such as externalities, monopolies, and information asymmetry. These market failures can have significant and wide-reaching consequences.

• Externalities: Externalities are unintended side effects of economic activities, such as pollution, that aren't accounted for in market transactions. These external costs can lead to environmental degradation and health problems, imposing burdens on society.

• Monopolies: Monopolies, where a single entity dominates a market, can stifle competition and lead to higher prices and reduced innovation. Consumers may suffer from limited choices and higher costs.

• Information Asymmetry: Information asymmetry occurs when one party in a transaction has more information than the other, potentially leading to unfair outcomes. This can undermine the trust and efficiency of markets.

For a comprehensive understanding of the concept of market failures, you can refer to the Principles of Economics Open Textbook by the University of Minnesota, specifically the chapter titled “Market Failure” https://open.lib.umn.edu/principleseconomics/chapter/6-3-market-failure/

This resource provides educational insights into the theoretical aspects of market failures.

To underscore the real-world implications of these market failures, consider:

The 2008 Financial Crisis: The 2008 financial crisis is a well-documented event that resulted from a combination of factors, including risky lending practices and inadequate regulation in the housing market. This crisis had profound economic and societal repercussions, demonstrating the far-reaching consequences of market failures. https://en.wikipedia.org/wiki/2007-2008_financial_crisis

For additional insights into the 2008 financial crisis, you can also explore the CNN Money article titled “Ben Bernanke: 2008 financial crisis was worse than the Great Depression”

https://money.cnn.com/2014/08/27/news/economy/ben-bernanke-great-depression/index.html

Monopoly Stakeholder Capitalism:

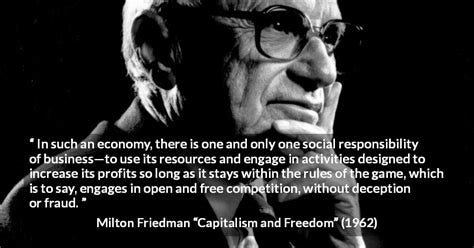

a. Benefits: Social Responsibility

Monopoly stakeholder capitalism places a strong emphasis on the ethical and social responsibilities of corporations, encouraging them to consider the interests of various stakeholders, including employees, customers, and the environment. This commitment to social responsibility is exemplified by companies like Tesla, a leader in sustainable transportation and renewable energy solutions. Tesla's innovative approach not only prioritizes environmental concerns but also resonates with a growing number of conscious consumers. The article on "Socially Responsible Companies" https://leaders.com/articles/business/socially-responsible-companies/ further highlights how businesses actively engaged in social responsibility initiatives positively impact society.

By showcasing examples of companies like Tesla and referencing articles that shed light on the positive outcomes of social responsibility, we can better understand the benefits of this approach within Monopoly Stakeholder Capitalism.

b. Drawbacks: Reduced Efficiency and Innovation

Critics contend that the emphasis on stakeholder interests can hinder efficiency and innovation, as decision-making processes may become more complex and less responsive to market demands. The challenges associated with balancing diverse stakeholder needs can, at times, lead to operational inefficiencies.

As the article "New Challenges in the Era of Stakeholder Capitalism" by Alva Group highlights,

“It’s vital that the responsibility for acting on the information does not sit within individual silos within an organisation, fragmenting responses rather than building a co-ordinated effort.”

https://www.alva-group.com/blog/new-challenges-in-the-era-of-stakeholder-capitalism/

This underscores the need for organizations to establish a coordinated approach in responding to stakeholder concerns to minimize potential inefficiencies.

c. Potential for Government Influence

Furthermore, the active engagement of government in the regulation and enforcement of stakeholder interests may engender apprehensions regarding potential government intervention in the economy. The resultant heightened regulatory landscape could, in turn, give rise to inefficiencies and unforeseen repercussions.

In this complex milieu, it becomes imperative to meticulously deliberate upon the delicate equilibrium between stakeholder capitalism and government supervision. While stakeholder capitalism ardently endeavors to address multifarious societal concerns, the imposition of an excessive regulatory framework has the potential to inadvertently curtail innovation and impede economic growth. For a more profound exploration of this intricate matter, readers are encouraged to delve into this comprehensive analysis: Making Stakeholder Capitalism a Reality

Should you desire to complement this discussion with an alternate perspective, you may also refer to this article:

Stakeholder Capitalism's Left-Wing Agenda

Balancing Approaches:

a. Hybrid Models: Some argue that a combination of free market principles and stakeholder considerations can yield a more balanced and effective economic system. This approach aims to harness the benefits of free market capitalism while incorporating ethical considerations and promoting long-term sustainability. For a deeper exploration of hybrid work models and their financial advantages, you can refer to this article on Forbes:

The Financial Advantages of a Hybrid Work Model https://www.forbes.com/sites/glebtsipursky/2023/01/18/the-financial-advantages-of-a-hybrid-work-model-a-hybrid-work-experts-perspective/

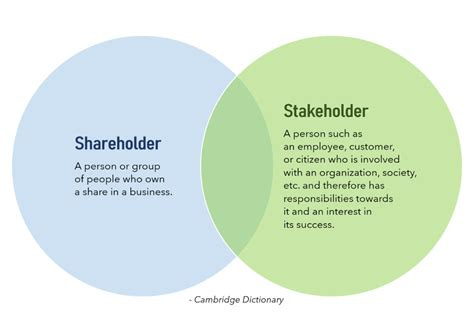

b. Regulatory Frameworks: Establishing clear and effective regulations can address the drawbacks of both systems. Regulations that promote competition, prevent anti-competitive practices, and ensure fair market conditions can enhance the efficiency of free market capitalism. Simultaneously, regulations that encourage corporate social responsibility and stakeholder engagement can mitigate the negative impacts of unchecked capitalism. For insights into managing shareholders in the age of stakeholder capitalism, you may find this Harvard Business Review article enlightening:

Managing Shareholders in the Age of Stakeholder Capitalism https://hbr.org/2022/08/managing-shareholders-in-the-age-of-stakeholder-capitalism

Conclusion:

Free market capitalism and monopoly stakeholder capitalism represent two distinct economic systems with their respective merits and drawbacks. Free market capitalism has shown its potential for economic efficiency, individual freedom, and wealth creation, while also facing challenges related to income inequality and market failures. Monopoly stakeholder capitalism emphasizes social responsibility, long-term sustainability, and fairer wealth distribution, but may encounter difficulties in maintaining efficiency and innovation. Striking a balance between these approaches, through hybrid models and effective regulatory frameworks, can harness the strengths of both systems while mitigating their weaknesses, leading to a more prosperous and inclusive economic landscape.